Investing in multifamily real estate as a passive investor has many key benefits. You can grow your wealth more quickly than investing in single and small multifamily properties (less than 5 units), grow your portfolio quicker, potentially earn returns that outpace other investment vehicles, enjoy tax benefits through depreciation, and not have to do any of the actual property management work!

Multifamily real estate is generally defined as apartment communities or apartment complexes. Many such multifamily apartment communities are purchased by large corporations, but others are purchased by a team of people like you and us, whereby each passive investor contributes capital and receives a return based on the profits earned by the property. This is a completely legal form of investing and is governed by rules created by the U.S. Securities and Exchange Commission.

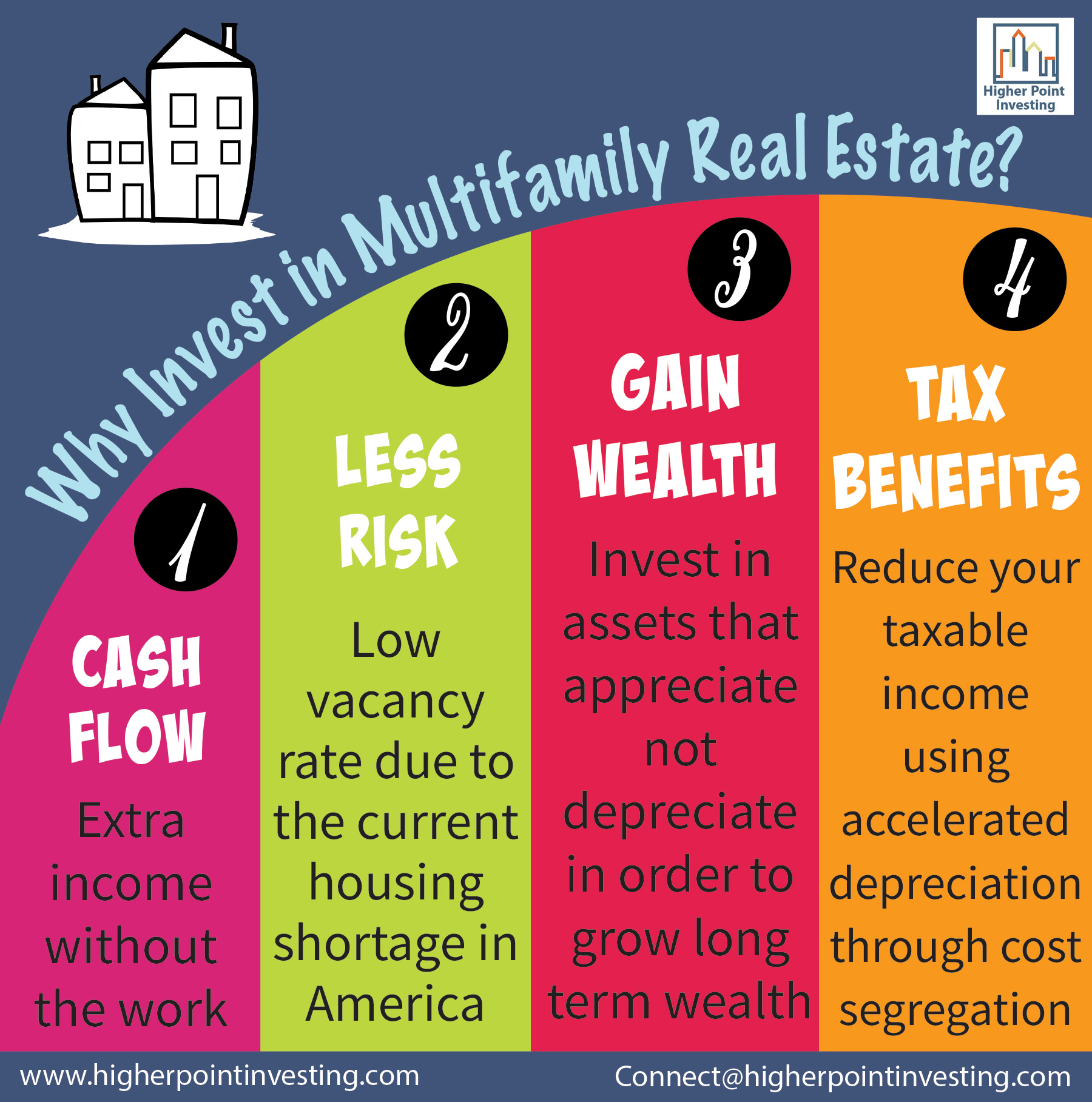

Every investment has some form of risk, however we and many people we know have seen and enjoyed success in multifamily investing, and we want to share these four top benefits that investor enjoy!

Apartments provide consistent cash flow with rents being collected each month. Most apartments are rented on 1 year leases, which helps ensure that cash flow each month keeps coming. Stocks, on the other hand, can be unpredictable and may only pay investors when the stock provides dividends. Multifamily investors know they are not in it for a quick windfall. The typical time that investment capital is held can be 5 to 7 years, and returns could average 15 to 20 percent or more.

The United States currently is 4.5 million dwelling units shy of demand, and many people prefer to live in apartments. If an apartment has low vacancy, especially with unit shortages, the risk of the property getting into financial trouble is less because the units that are rented are providing income to keep the property moving forward.

The property itself is where the value. Well managed properties in good markets rarely lose all of their worth, rather they tend to appreciate in value, especially with opportunities to improve the units and property overall. Other investment vehicles are not always based on real estate, and can lose their value for a variety of reasons.

Real estate has some special tax advantages. As a real estate investor (as defined by the IRS), people can claim mortgage interest deductions and accelerated depreciations which can offset cash flow income. In addition, cost segregation depreciation can be additional bonus tax benefits. Also, many real estate investors can benefit from the IRS 1031 Exchange rules, which allow them to migrate proceeds from the sale of one multifamily property into another one, thereby deferring all taxable gains into the future.